Micro-Small-and-Medium Enterprise Loans are another name for MSME Loans. They are of great assistance to startups and small businesses. An MSME loan can be used for a number of business needs, including the purchase of merchandise, the upgrading of equipment, the expansion of office space, the payment of employee salaries, and more.

Application for an MSME loan is now simpler than ever. All you have to do is choose your preferred lender, complete the online application form, and attach the required documentation. Once the loan is granted, the funds are automatically credited to your bank account. We walk you through the process of submitting an online MSME loan application in this article.

How to apply for an MSME loan online

- Choose a lender. You must choose a lender before submitting an online application for an MSME loan. Make careful to compare the MSME loans given by various lenders’ interest rates, eligibility requirements, features, and other specifics.

- Visit the bank or NBFC’s official website of your choice.

- Use your login ID and password to access your banking account if you already have a bank account. You can still apply for an MSME loan if you’re not already a client, but you must first open an account with the bank or NBFC.

- Go to the section on MSME loans. Find the online application form there. Enter the necessary information. It consists of data on you personally, your company, your earnings, and other specifications.

- After completing all the fields, upload the necessary supporting documents online. The majority of lenders demand that you submit documentation for your KYC, ownership of the firm, ITR, profit-loss statements, and business bank account information.

- Verify that you have given all the necessary information. Online application submission is required.

- The application number will be sent to you after you submit the form. To facilitate future discussions with the lender, make sure to write down this number.

- You submit a loan application to the bank. The loan officer will then get in touch with you to finalize the loan’s additional details.

- Depending on the lender, you might need to go in person to the local branch to finish the loan formalities. However, the majority of lenders in existence today accept loan applications entirely online.

- You might need to visit the local bank in person to complete the loan requirements, depending on the lender. However, the vast majority of lenders in operation today only accept online loan applications.

Points to Keep in Mind, Before Applying for an MSME Loan Online

Calculate business requirements

Understanding your company’s needs is the first step before you start looking for an MSME loan online. Examine your present business requirements, your short- and long-term financial objectives, and the main reasons behind your application for an MSME loan. It’s a good idea to have a clear target of how much money you need to borrow, how you want to utilize it, and the anticipated profits from your company. You will be ready for any queries the lender may have thanks to this.

Choose the right lender

Despite the ease with which MSME loans are accessible, not all lenders would provide a loan offer to you. Different lenders have different requirements for MSME loan eligibility. Therefore, it makes sense to examine if you fulfill the eligibility requirements at your selected lender. Other elements to take into account when selecting a loan include:

- Interest Rates

- Loan Amount

- Processing Fees

- Repayment Tenure

- Ease of Application

- Terms and Conditions

Apply online

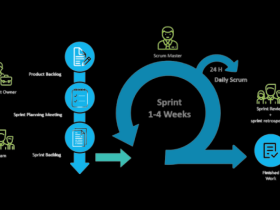

The most straightforward approach to applying for an MSME loan is online thanks to the growth of digital banking. The entire loan application procedure, from approval to disbursal, is expedited by using an easy, hassle-free online application. For a better understanding of the online loan application procedure, read the procedures listed above.

Have the required documents ready

Lack of required documentation from the applicant is the main cause of slow loan approval times or loan rejections. So, be sure to have all the paperwork needed by the lender before you start the loan application process. To make it simple to submit the documents during the online application, upload them to Google Drive or another cloud service.

Maintain a good credit score

The majority of MSME loans lack collateral. Lenders, therefore, use your credit score to determine your creditworthiness. If you have a credit score of 750 or higher, this is in your favor and will speed up the loan process. Check both your personal and corporate credit scores, as lenders take into account both of these things.

Leave a Reply